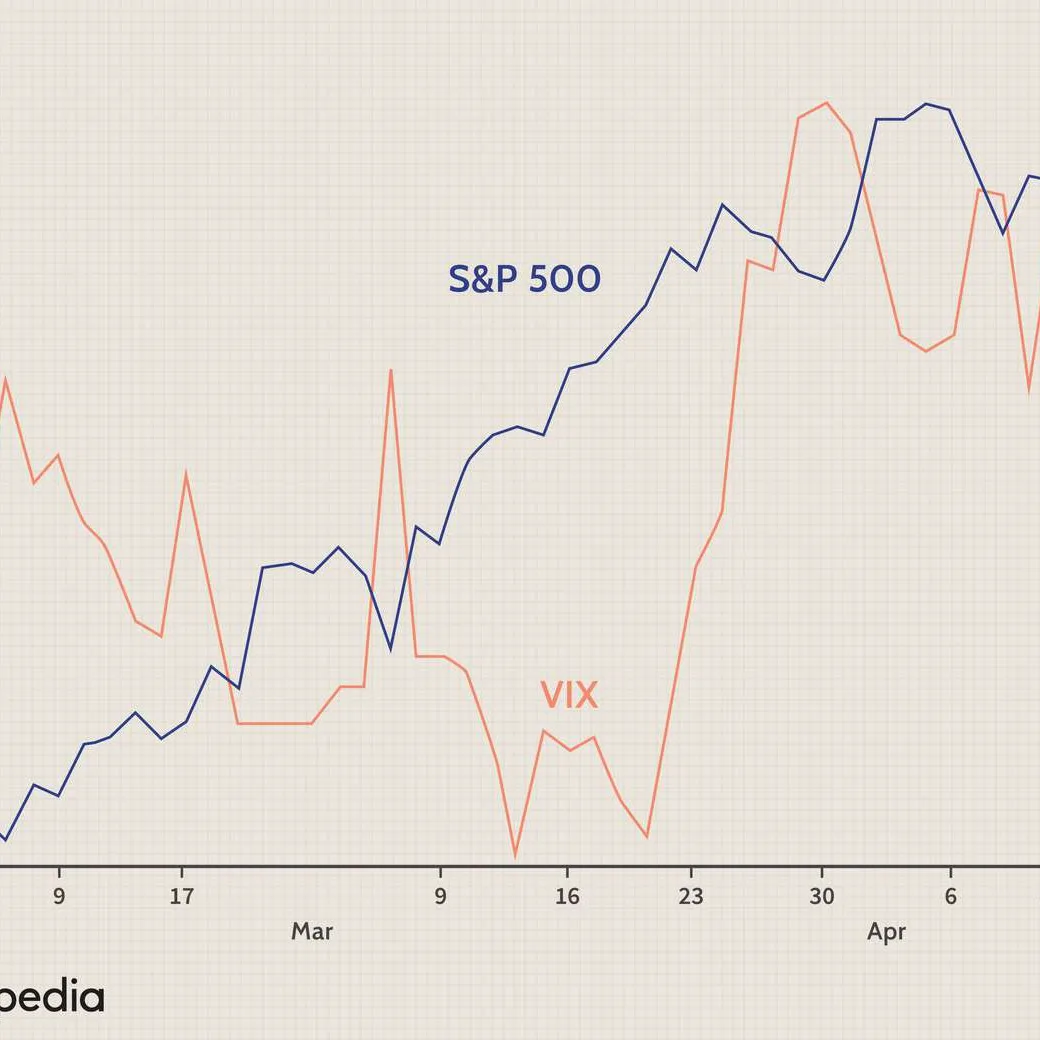

The VIX, commonly referred to as the fear index, has returned to a neutral level following a recent correction in the stock market. This development marks a significant shift in market sentiment. According to recently published data on Seeking Alpha, the VIX level has shown resilience but is indicative of a stabilized market environment, where fear and volatility have tempered. Analyst comments suggest that while the short-term outlook remains cautious, the return to a neutral VIX level provides a baseline that investors may consider when strategizing future trades. The implications of this shift could lead to a resurgence of investor confidence in equities, as the VIX’s normalization signals reduced uncertainty. Furthermore, analysts urge caution against the backdrop of the ongoing economic challenges, highlighting that the market corrections incurred have not fully addressed the underlying economic turbulence. As observed in previous trends, the VIX typically reflects broader economic conditions, and its current state could be a precursor to more stable trading conditions ahead. The report also emphasizes awareness of macroeconomic indicators to leverage investment strategies effectively.

VIX Risk Indicator Returns to Neutral Level After Recent Stock Market Correction