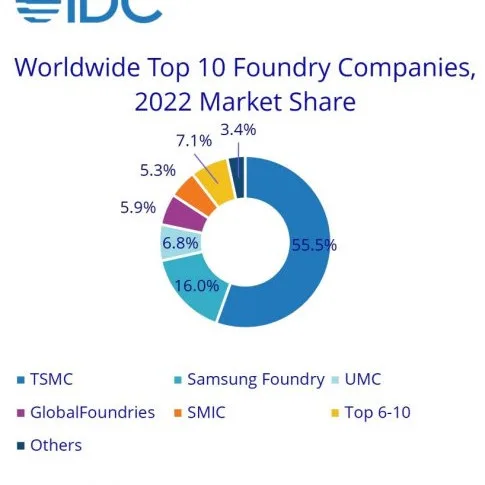

Shares of Taiwan Semiconductor Manufacturing Company (TSMC) have experienced a significant downturn, declining to about $78.89, marking a drop of approximately 5% during a volatile session on the U.S. stock market. This decline brings TSMC’s year-to-date performance to a staggering loss of nearly 30%, intensifying concerns among investors regarding the company’s financial health amid slowing demand for chips. TSMC, a key player and backbone of the artificial intelligence industry, plays a critical role in producing chips for various tech giants, including Apple, Nvidia, and Intel. The company’s substantial market share in the semiconductor industry, coupled with its strategic agreements with major tech firms, has historically positioned it as a sturdy investment. However, the current market climate, driven by economic uncertainty and fluctuating demand, has raised alarms. “We’re facing a challenging period, and while we believe in TSMC’s long-term potential, the market sentiment is undeniably negative right now,” one analyst noted. Recent patterns indicate TSMC’s stock may be undervalued at current prices, especially considering its pivotal role in the global AI market, which continues to expand. Despite the fluctuations, institutional investors have shown interest, with many evaluating the potential rebound of TSMC shares. TSMC’s ability to innovate and adapt to changing technological demands will be vital as it navigates this downturn, especially with forecasts hinting at potential recovery if demand stabilizes. As we assess the broader economic implications, many industry experts urge caution while remaining optimistic about TSMC’s resilience, emphasizing that strong fundamentals remain intact despite the recent price drop.

TSMC Stock Plummets Amid Economic Concerns: A Deep Dive into Market Dynamics