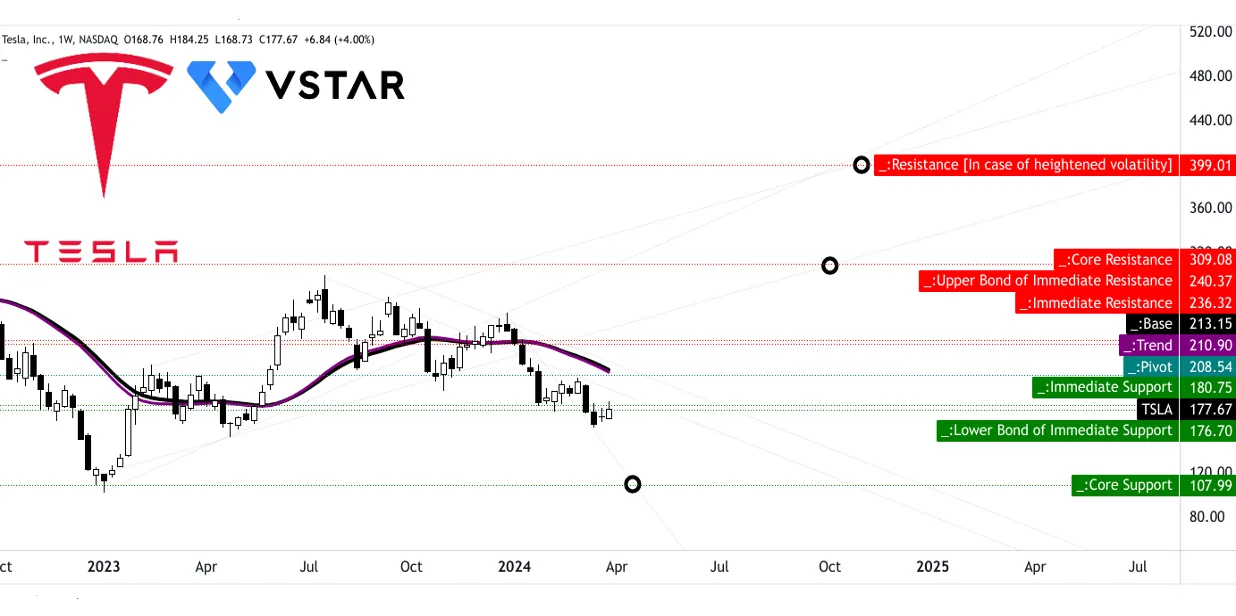

Tesla Inc. shares experienced a significant surge, climbing to levels not seen in over a year, spurred by optimistic analyst upgrades and positive sentiment surrounding the electric vehicle (EV) market. Wall Street analysts, reflecting renewed confidence in Tesla’s growth trajectory, have revised their price target for the stock. Notably, an analyst from Deutsche Bank has increased the price target for Tesla to $515, highlighting the company’s robust production capabilities and strong demand for its electric vehicles. During an investor conference, Elon Musk expressed his hope for Teslas stock to reach $690 per share in the longer term, emphasizing the importance of scaling production and innovation. The stock’s impressive climb has also been supported by an increase in deliveries, showcasing Tesla’s resilience in the face of economic challenges. As of the latest reports, Tesla shares rose by nearly 12%, underlining a bullish trend among investors and marking a recovery from previous fluctuations. Analysts believe this surge lays a strong foundation for Tesla’s performance in the upcoming quarters. Investors and market observers remain optimistic, citing Tesla’s ongoing expansion and advancements in battery technology as critical factors that could drive future stock performance.

Tesla Stock Surges as Analysts Boost Price Target Amid Optimism