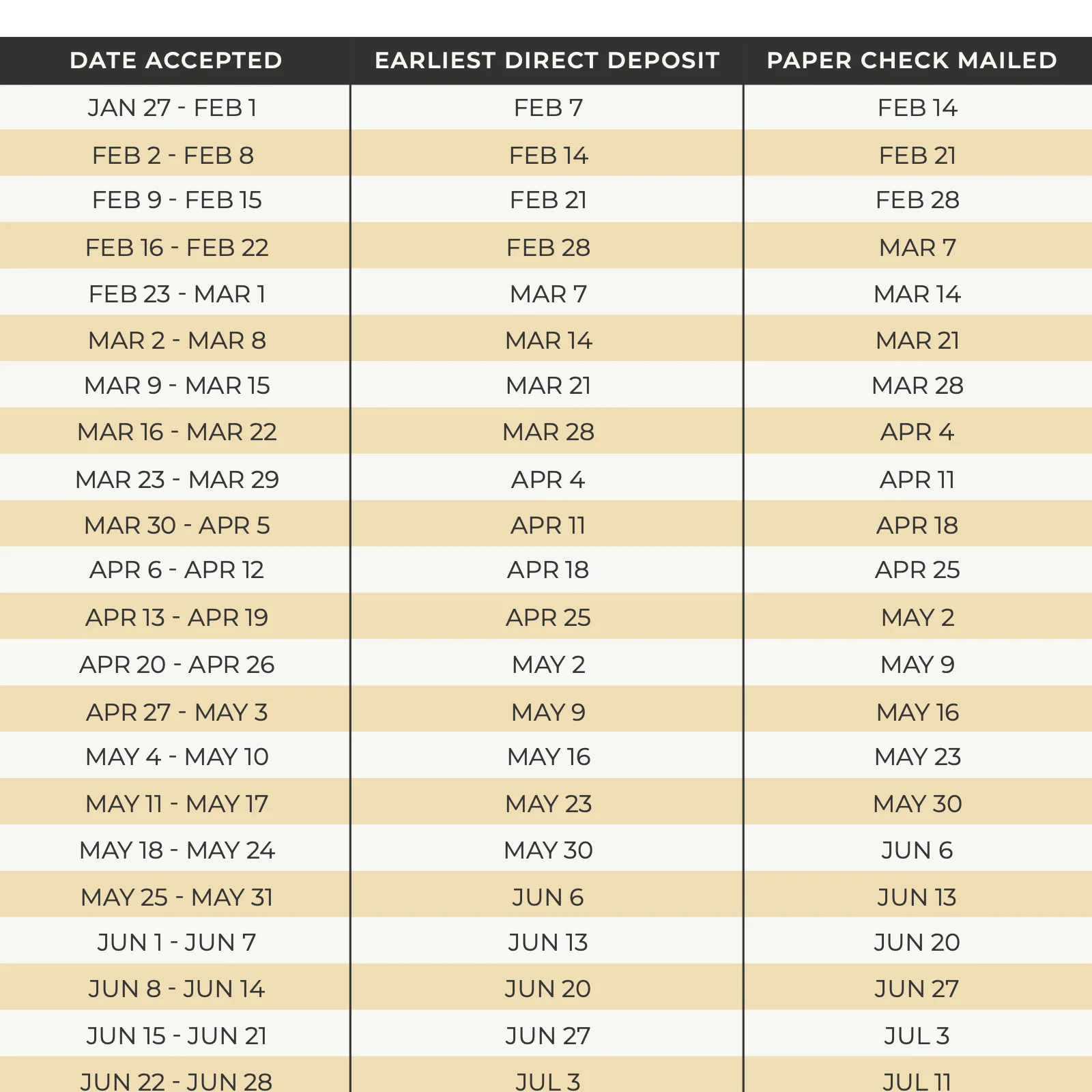

The 2025 tax filing season has officially commenced as the IRS has begun accepting tax returns. Taxpayers are encouraged to file their returns early to avoid potential delays. To assist individuals in this process, the IRS emphasizes that there are numerous options available for obtaining help, including online resources and in-person assistance. Taxpayers should be aware of critical dates that are essential for their filing, including the deadline for filing tax returns, which is set for April 15, 2026. Additionally, the IRS provides updates on how long taxpayers can anticipate waiting for their refunds. In general, most taxpayers can expect their tax refunds within 21 days of e-filing, provided that there are no issues with the returns. The IRS states, “Filing electronically and choosing direct deposit is the fastest way to receive a refund.” It’s advisable for taxpayers to stay updated on their refund status through the IRS’s online tool, Where’s My Refund? The IRS aims to reduce processing times and improve efficiency for a smoother tax season experience.

Tax Season 2025 Begins: Key Dates and Refund Tracking Information