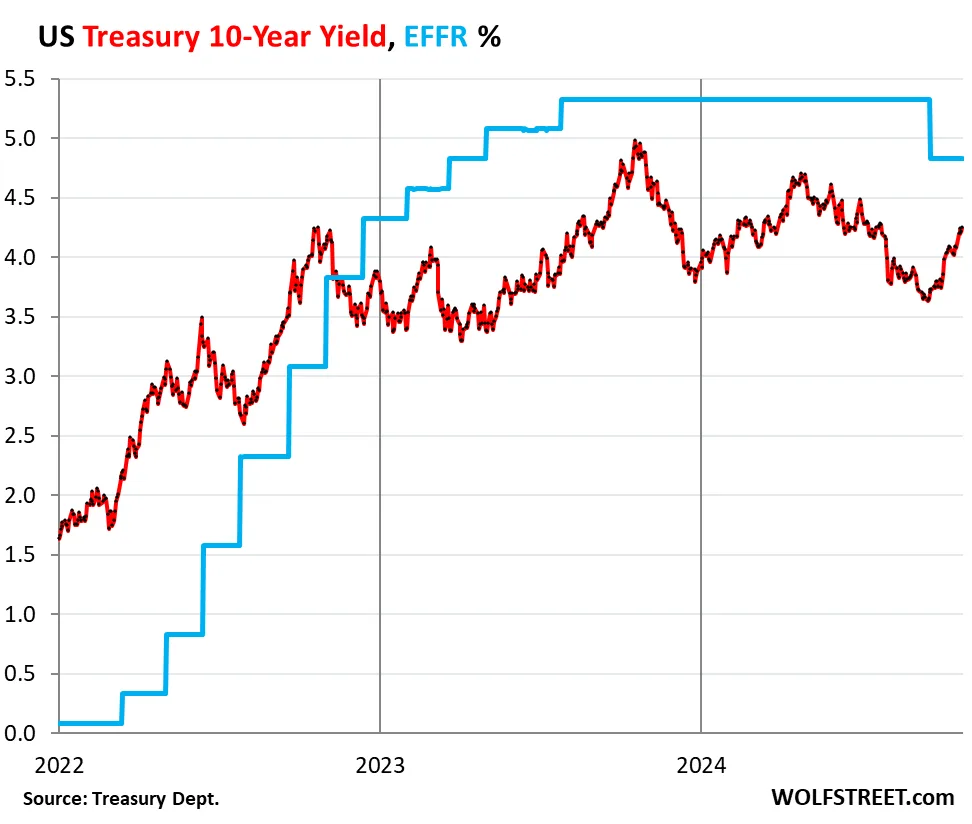

The stock market faced significant downturns on December 27, 2024, as major indices such as the Dow Jones Industrial Average, S&P 500, and Nasdaq all experienced notable slides. The Dow fell by 500 points, closing at 34,260, while the S&P 500 dropped 1.5% to finish at 4,820. The Nasdaq composite saw a 2% decline, ultimately closing at 14,560. This decline in the stock market is largely attributed to rising Treasury yields, which reached 4.1%, nearing a seven-month high. Analysts are expressing concern that the Federal Reserve may extend its rate-hiking regime into the new year, despite ongoing inflation struggles. “Higher rates mean higher borrowing costs and could diminish consumer spending, which is crucial for economic growth,” noted Tom Lee, a prominent market strategist. On top of this, the housing market is also feeling the pinch, with home sales plummeting by 20% year-over-year. Investors are now bracing for a cautious approach in 2025 as uncertainty looms over inflation dynamics and potential Fed actions.

Stock Market Declines Amid Rising Treasury Yields