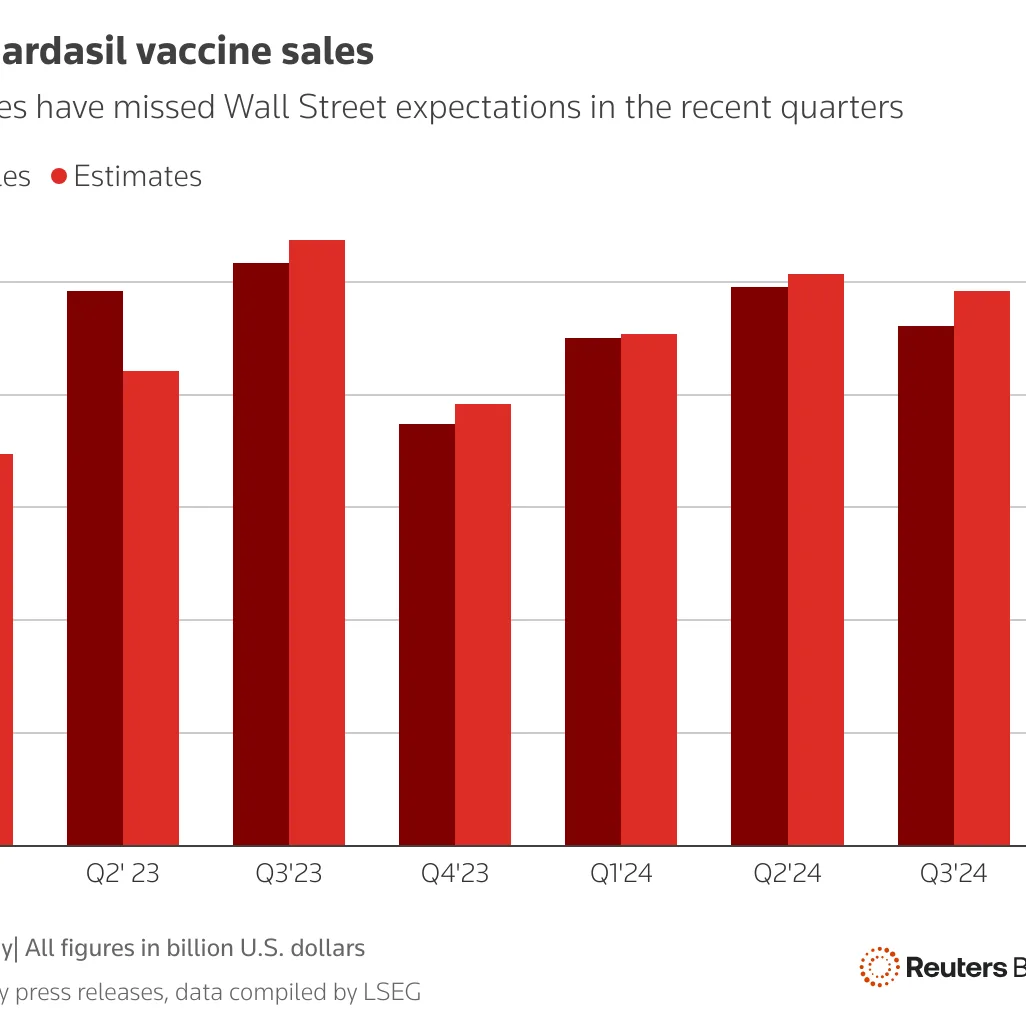

Merck (NYSE: MRK) reported its fourth-quarter earnings for 2024, showcasing a mixed performance that has raised concerns among investors for the upcoming year. The company revealed an earnings per share (EPS) of $1.92, which was $0.02 above the analysts’ expectations. However, the total revenue for the quarter came in at $14.98 billion, slightly missing estimates of $15.20 billion. Merck’s CEO, Rob Davis, stated, “While we are pleased with our EPS performance, the lower-than-expected revenue highlights some challenges we must address moving forward.” A significant factor contributing to Merck’s outlook in 2025 is its decision to halt the sales of its HPV vaccine, Gardasil, in China. This move has sparked considerable worry regarding the company’s growth prospects in a vast market that was previously considered crucial for future revenues. Additionally, the company anticipates that this halt will negatively impact its overall sales figures in 2025, potentially affecting earnings growth and investor confidence. The news comes as Merck’s stock is facing pressure in early trading after the earnings report, and analysts are now closely watching the company’s strategic responses to the ongoing market challenges. Rob Davis further commented, “We understand the pivotal role Gardasil plays in our portfolio and are evaluating our strategy and presence in Asian markets going forward.” As Merck navigates this complex landscape, investors will be keen on updates regarding its pipeline and market strategies as the company aims to mitigate the impacts of this significant decision.

Merck’s Q4 2024 Earnings Reveal Challenges Ahead Due to Halting Gardasil Sales in China