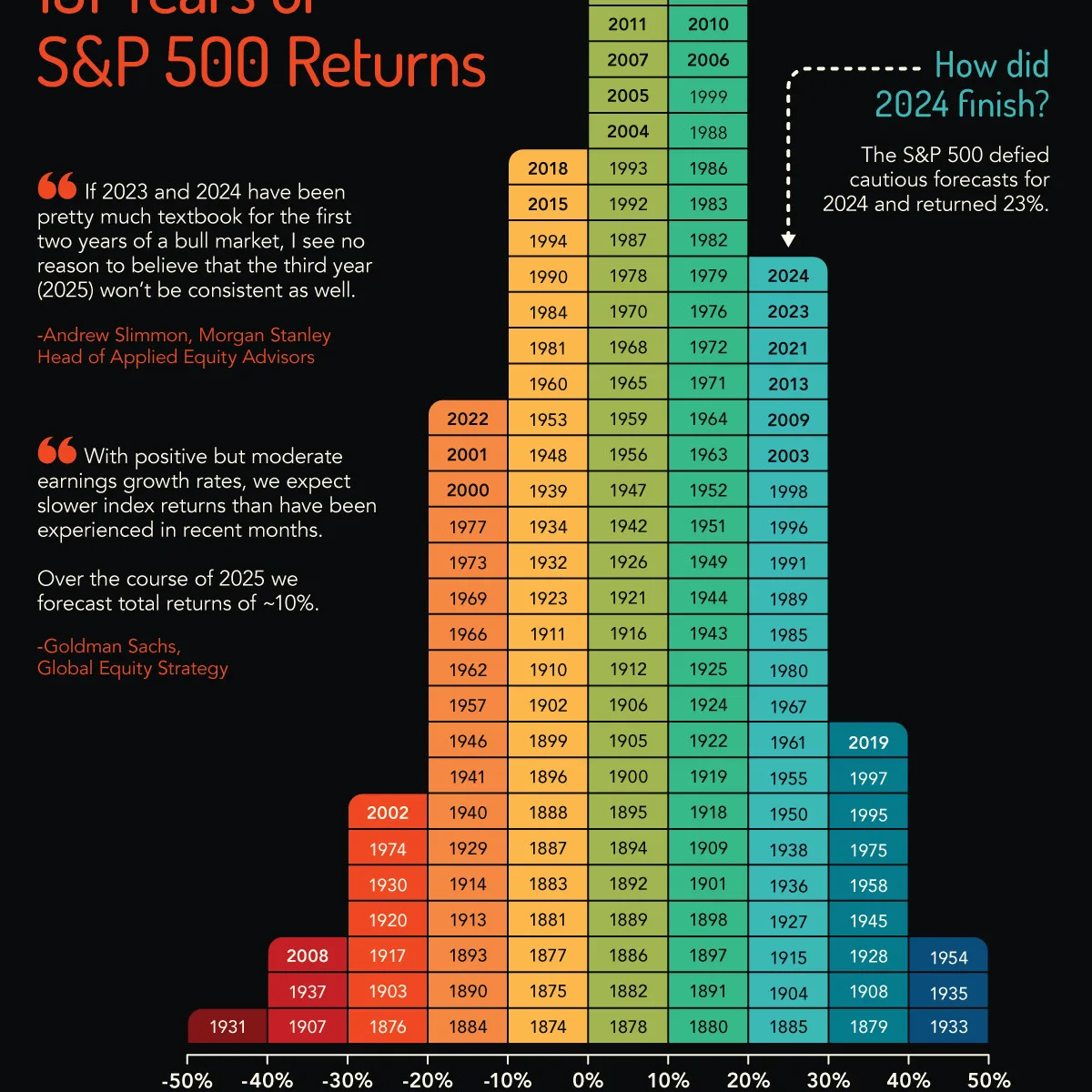

As the S&P 500 index kicks off March 2025, it faces notable volatility, marked by its biggest drop in months. A convergence of factors is troubling investors, particularly concerns about market concentration that have developed over the past 145 years, as outlined in recent analyses. Visual Capitalist highlights that the S&P 500 has been increasingly dominated by a handful of companies, raising alarms about vulnerability to market shifts. ‘Concentration in the stock market has reached levels that could precipitate significant corrections,’ says an unidentified market analyst. Concurrently, an update from CNBC adds that analysts believe the S&P 500 could soon test its 200-day moving average as it dips sharply due to external pressures. Additionally, MSN informs that President Trump’s new tariff policies have rattled market sentiments, contributing to this volatility. ‘Investors are anxious about the implications of these tariffs, which adds another layer of uncertainty,’ noted a financial strategist. With investors uncertain about the immediate future, the combination of concentrated market power and instructive tariff policies could lead to further turbulence for stocks in the upcoming weeks.

Market Volatility: S&P 500 Experiences Significant Drops Amid Concentration Concerns and Tariff News