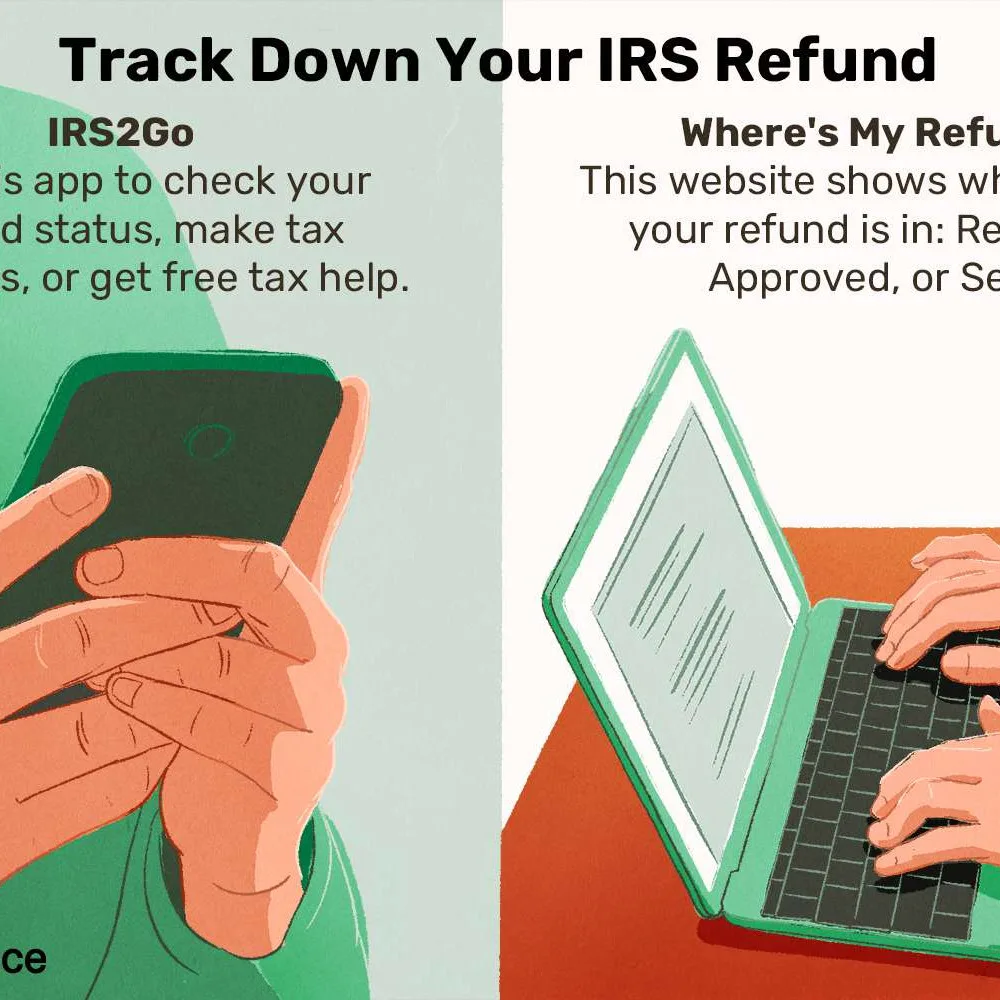

As taxpayers across the United States are experiencing delays in receiving their tax refunds, the Internal Revenue Service (IRS) has updated its online tools to help individuals track their refund status. The IRS has advised taxpayers to refrain from calling their offices and instead use their online resources for quicker assistance. According to the IRS, ‘Most refunds are issued within 21 days, but some may take longer due to various factors.’ With the tax filing season underway, many individuals are eager to understand the status of their refunds. The IRS emphasizes the importance of checking the ‘Where’s My Refund?’ tool on its website, which provides real-time updates. By inputting their Social Security number, filing status, and the exact amount of their refund, taxpayers can access detailed information regarding their refunds. Furthermore, IRS Commissioner Chuck Rettig stated, ‘We urge taxpayers to use our online tools. They’re the fastest way to find the help you need.’ In light of ongoing processing challenges, the IRS has encouraged patience, reminding taxpayers that possible factors leading to refund delays may include errors in the tax return, incomplete returns, or potential identity theft issues. In addition to tracking refunds, taxpayers can also access information regarding their tax filings and payments through the IRS website, helping them stay informed and proactive during this critical period.

IRS Offers Guidance on Tracking Tax Refunds Amid Refund Delays