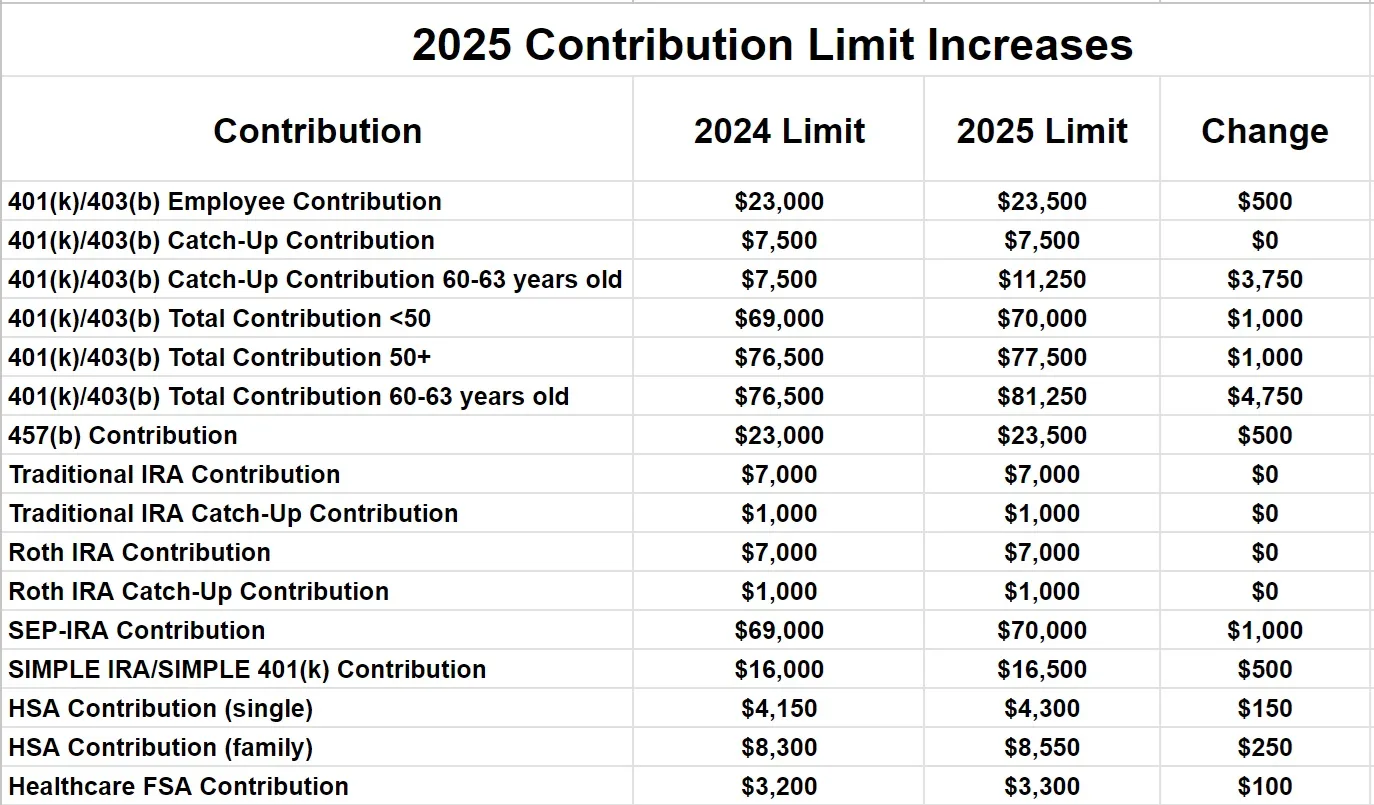

The Internal Revenue Service (IRS) has officially announced new contribution limits for retirement plans, effective January 1, 2025. This adjustment reflects changes to cost-of-living indices and aims to bolster the savings potential for American workers. For employee contributions to 401(k) plans, the limit has been raised to $22,500, an increase from the previous limit of $20,500. Additionally, those age 50 and over can now contribute a catch-up amount of $7,500, bringing their total contribution cap to $30,000.

The IRS also modified limits for other retirement accounts. The IRAs’ contribution limit will rise to $7,500, up from the current $6,500, with the catch-up contribution remaining the same at $1,000 for individuals aged 50 and older. These changes align with the IRS’s ongoing efforts to encourage higher retirement savings.

“These increases will allow individuals to save more for their retirement in the coming years,” commented a representative from the IRS, highlighting the importance of adequate preparation for future financial stability. Furthermore, the Thrift Savings Plan (TSP) limit for federal employees will receive a substantial boost, increasing to $22,500, with a similar catch-up limit for those over 50.

Experts advise individuals to take full advantage of these new limits to maximize their retirement nest eggs, especially given ongoing discussions about the sustainability of Social Security. According to financial analysts, maximizing contributions is critical in a time of economic uncertainty, particularly with inflation impacting the purchasing power of future retirees.

Overall, the anticipated spikes in contribution limits are expected to significantly impact the retirement landscape, offering increased opportunities for tax-advantaged savings.