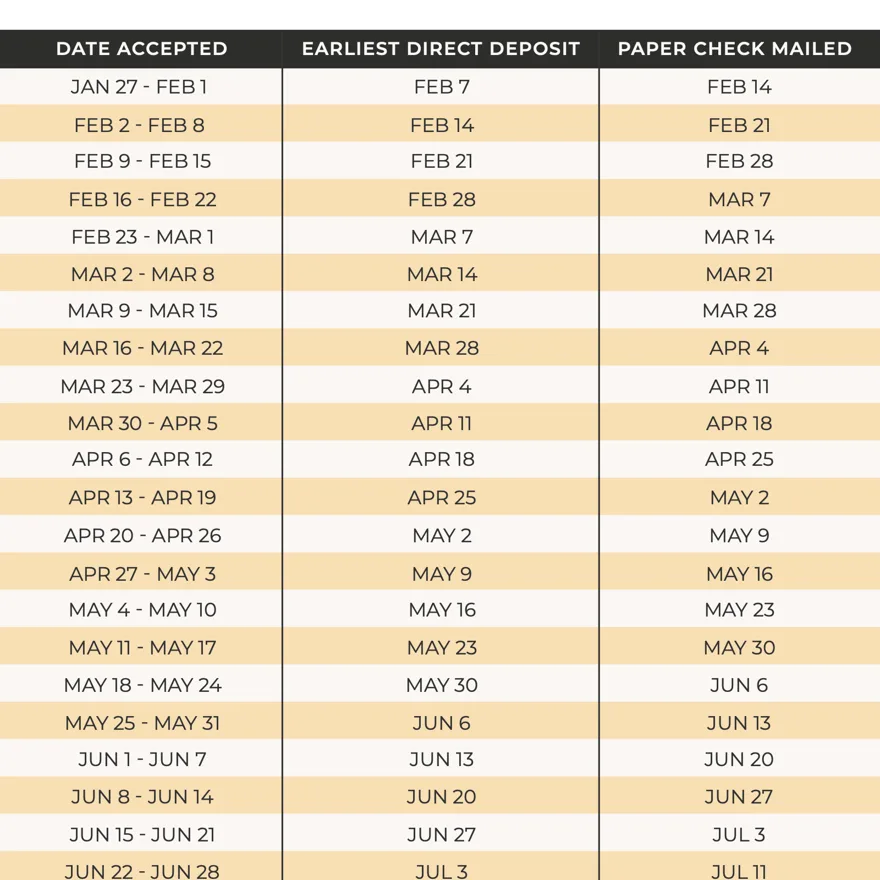

As the 2025 tax season approaches, the IRS has released important information regarding the income tax refund schedule. Early filers can expect their refunds much sooner than in previous years, with the first payments likely to be processed by mid-February 2025. According to the IRS, individuals who file taxes online and choose direct deposit could receive their refunds in as little as 21 days after filing. The average tax refund for early filers is projected to be around $3,200. Susan Tompor, a personal finance columnist from the Detroit Free Press, emphasizes that the refund amount could vary based on individual tax situations, credits, and deductions. It’s crucial for taxpayers to stay informed about changes in tax laws that may affect their refunds. The IRS refund tracker, a tool introduced in recent years, is recommended for taxpayers wanting to monitor the status of their refunds. Taxpayers can also expect an increase in the number of electronic filing options available to them this year. IRS representatives advise individuals to double-check their tax documents to ensure accuracy which could prevent delays. With these insights, it is clear that the 2025 tax season could offer significant financial relief for many individuals and families, especially as they plan for expenses in the coming year.

IRS Income Tax Refund Schedule for 2025: Key Dates and Average Refund Amounts