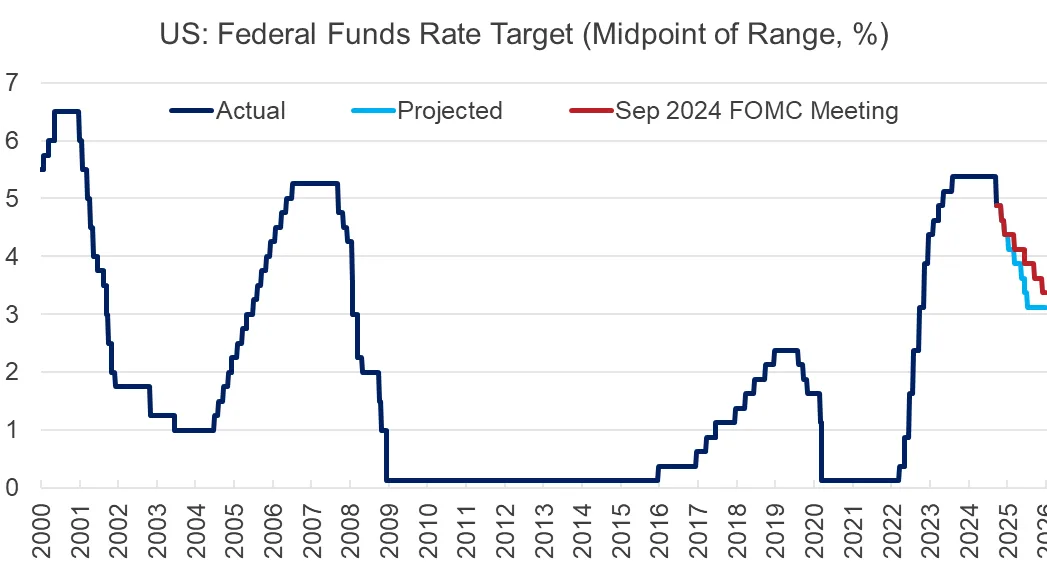

The Federal Reserve’s decision to maintain interest rates during its December 2024 meeting has raised questions about its future monetary policy direction as inflation remains persistent. Chair Jerome Powell acknowledged the challenges of balancing inflation control with economic stability, stating, “We are prepared to take additional actions if inflation does not start to decline in a sustainable way.” Despite expectations, experts have projected fewer cuts to interest rates in 2025, with continued inflation posing significant risks. Bill Conerly, an economist, emphasized that “the Fed is still facing persistent inflation, which has caused a reassessment of the likely trajectory of interest rates over the next year.” Current rates are set at 5.25% to 5.50%, and while some analysts had predicted cuts in early 2025, the Federal Reserve’s ongoing observations of economic indicators suggest a cautious approach moving forward. As markets react to these signals, investors are urged to remain vigilant about inflation trends in the coming months.

Federal Reserve’s Interest Rate Direction Remains Uncertain Amid Inflation Concerns