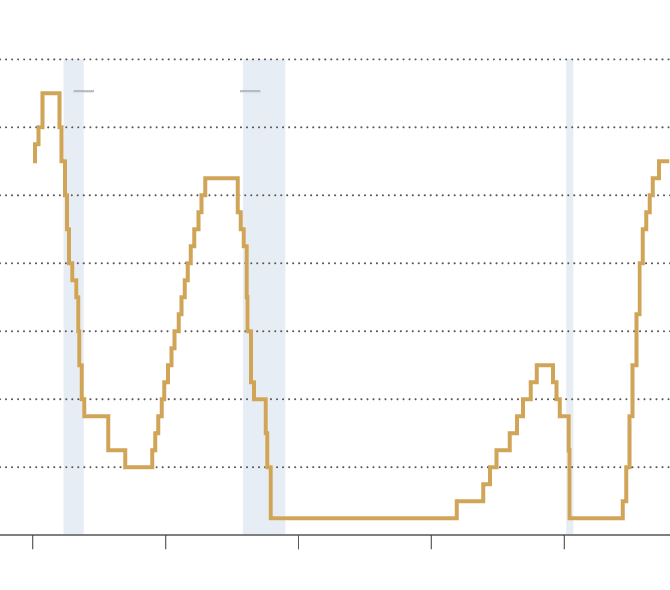

The Federal Reserve is preparing to cut interest rates in light of recent economic developments, as inflation appears to be stabilizing. At the last meeting of the year in December 2024, officials suggested that the balance of risks surrounding inflation and economic growth has shifted. Federal Reserve Chairman Jerome Powell stated, “We believe that the current economic conditions warrant a reassessment of our monetary policy. The outlook for inflation has improved significantly, and we are considering a modest rate cut in early 2025.” In accordance with the latest reports, the Fed’s decision comes after inflation rates dropped to a yearly increase of 2.9%, compared to 7.1% earlier in the year. Meanwhile, unemployment remains steady at 4.1%, reflecting resilience in the labor market despite rising borrowing costs. The base rate currently stands at 5.25%, with some economists suggesting a reduction to 5.00% could stimulate growth without reigniting inflation. Analysts at Bloomberg indicated, “A well-timed rate cut could foster economic activity while keeping inflation expectations in check.” This anticipated policy shift has garnered mixed reactions from financial markets, where volatility is expected as investors adjust to new forecasts and economic indicators. ‘The focus will now be on the Fed’s ability to communicate its strategy effectively,’ said Mark Zandi, chief economist at Moody’s Analytics.

Federal Reserve Signals Interest Rate Cuts in Response to Inflation Trends