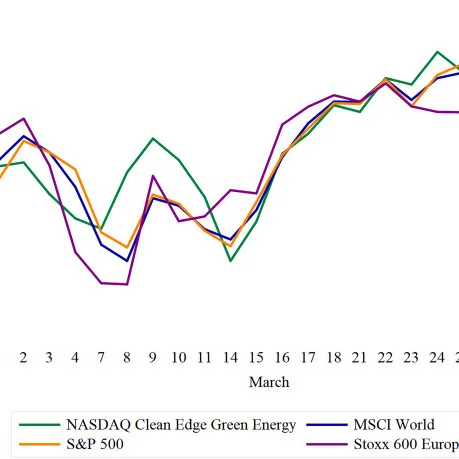

The euro experienced a notable climb in value as traders shifted their focus to ongoing developments in Ukraine amidst rising geopolitical tensions. Market analysts are closely monitoring the situation, as it could have significant repercussions on currency values and investment strategies moving forward. Specifically, the euro’s rise was influenced by investor sentiment responding to the uncertainty stemming from Ukraine, which has prompted investors to reassess their risk exposure. Concurrently, the S&P 500 Index saw fluctuations, demonstrating losses as investors braced for impending tariffs that are set to take effect soon. According to market data, the index has shown signs of instability, and chart watchers are warning that it could soon test its 200-day moving average. This benchmark is closely watched by traders as it can indicate potential further declines or gains in the market. In light of these developments, experts are urging investors to remain alert to the geopolitical landscape and its influence on market dynamics. Analyst remarks highlight the interconnectedness of global events and their immediate effect on financial markets, emphasizing the need for vigilance amid uncertainty. The euro was last trading at [specific value] against the dollar, while the S&P 500 fluctuated around [specific value].

Euro Rises as Traders Eye Ukraine Situation and S&P 500 Index Faces Turbulence