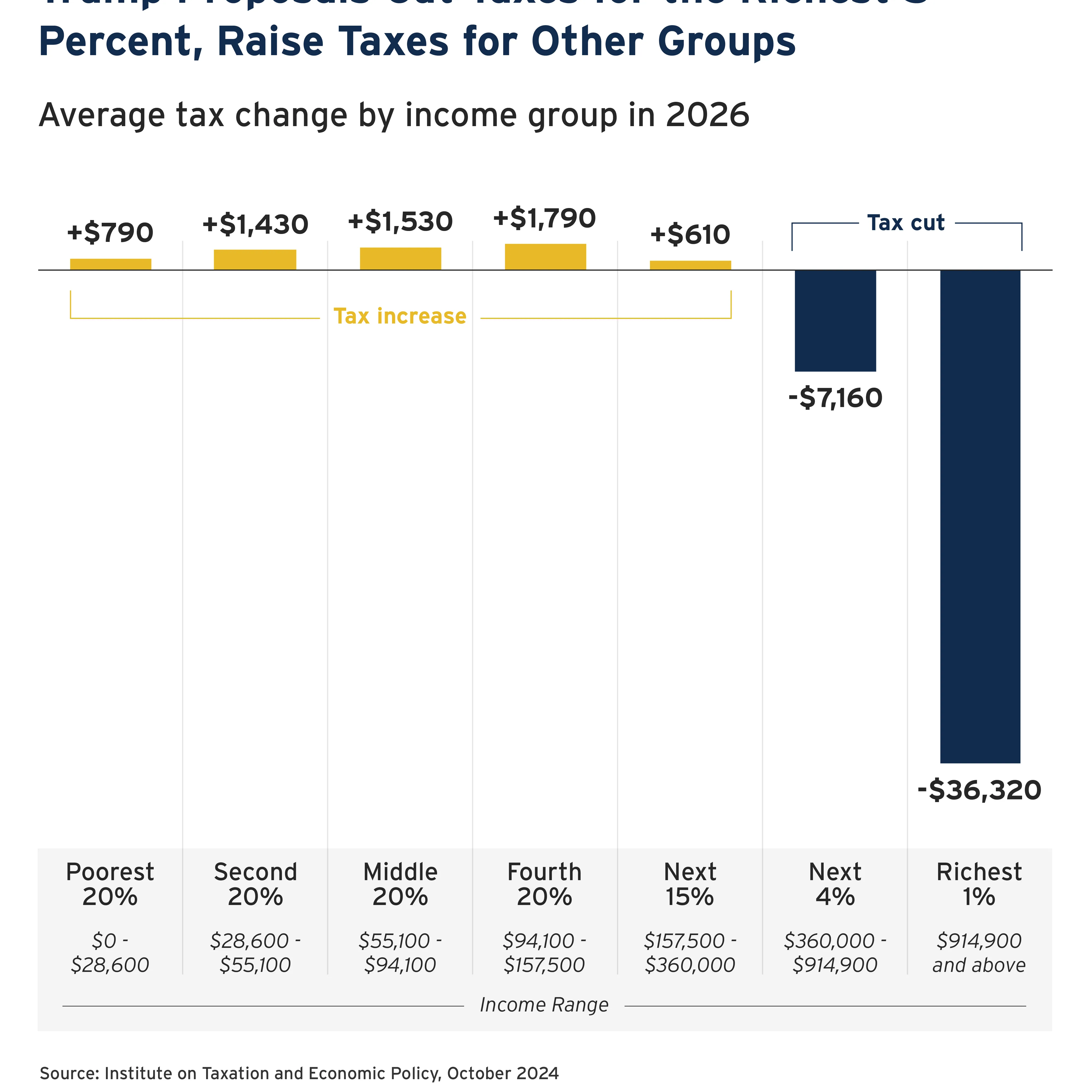

In a bold new proposal, former U.S. President Donald Trump has suggested a significant overhaul of the American tax system, advocating for the abolishment of federal income tax. His vision aims to replace the current system with tariffs, which he claims would ultimately make the United States ‘richer and more powerful’. Trump expressed that this approach would benefit Americans through more straightforward taxation methods and yield greater financial support. He stated, ‘It’s time for America to move beyond outdated taxes that hold our economy back. By eliminating the income tax and introducing tariffs on imports, we can stimulate growth and protect American jobs.’ Trump’s proposal suggests this radical shift in policy could create a more robust economy, suggesting that tariffs could incentivize domestic production while simultaneously reducing the tax burden on individuals. The implications of such a significant change would upheave existing economic structures, and it is expected to stir considerable debate among policymakers and economists alike. As discussions about tax reform heat up, Trump’s proposal will likely play a central role in the upcoming electoral campaigns.

Donald Trump Proposes Abolition of Federal Income Tax in Favor of Tariffs