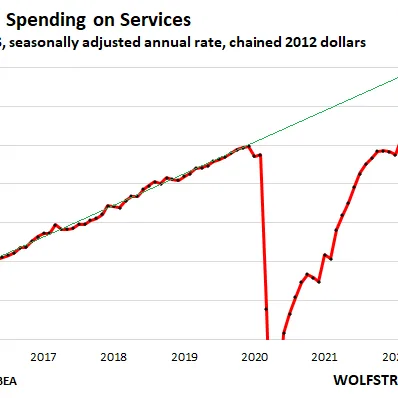

The latest reports reveal that consumer spending has seen a noticeable downturn as the Personal Consumption Expenditures (PCE) price index continued to rise in January 2025, marking a year-on-year change of 4.4%. This increase is largely attributed to ongoing inflationary pressures that have caused worries among economists and consumers alike. According to the U.S. Commerce Department, personal income adjusted for inflation rose by 0.3% in January, yet spending fell by 0.2%, highlighting the challenges faced by American households. Additionally, the core PCE, which excludes food and energy prices, experienced a year-over-year increase of 4.6%, prompting discussions among Federal Reserve officials regarding potential interest rate increases. The Fed has maintained its target rate between 5.25% and 5.50% amid rising costs, with inflation being a critical focus area. “Consumers are feeling the pinch and are more cautious with their purchases,” said Chief Economist at a leading financial institution. The latest data is expected to have significant implications for the upcoming Federal Reserve meeting, where policymakers will review these inflation trends and assess their impact on monetary policy decisions moving forward. The persistent inflation remains a topic of concern despite slight month-over-month improvements in some areas of spending. Analysts predict that consumer behavior may shift further as households navigate these economic challenges throughout the year 2025.

Consumer Spending Declines Amid Rising PCE Inflation in January 2025