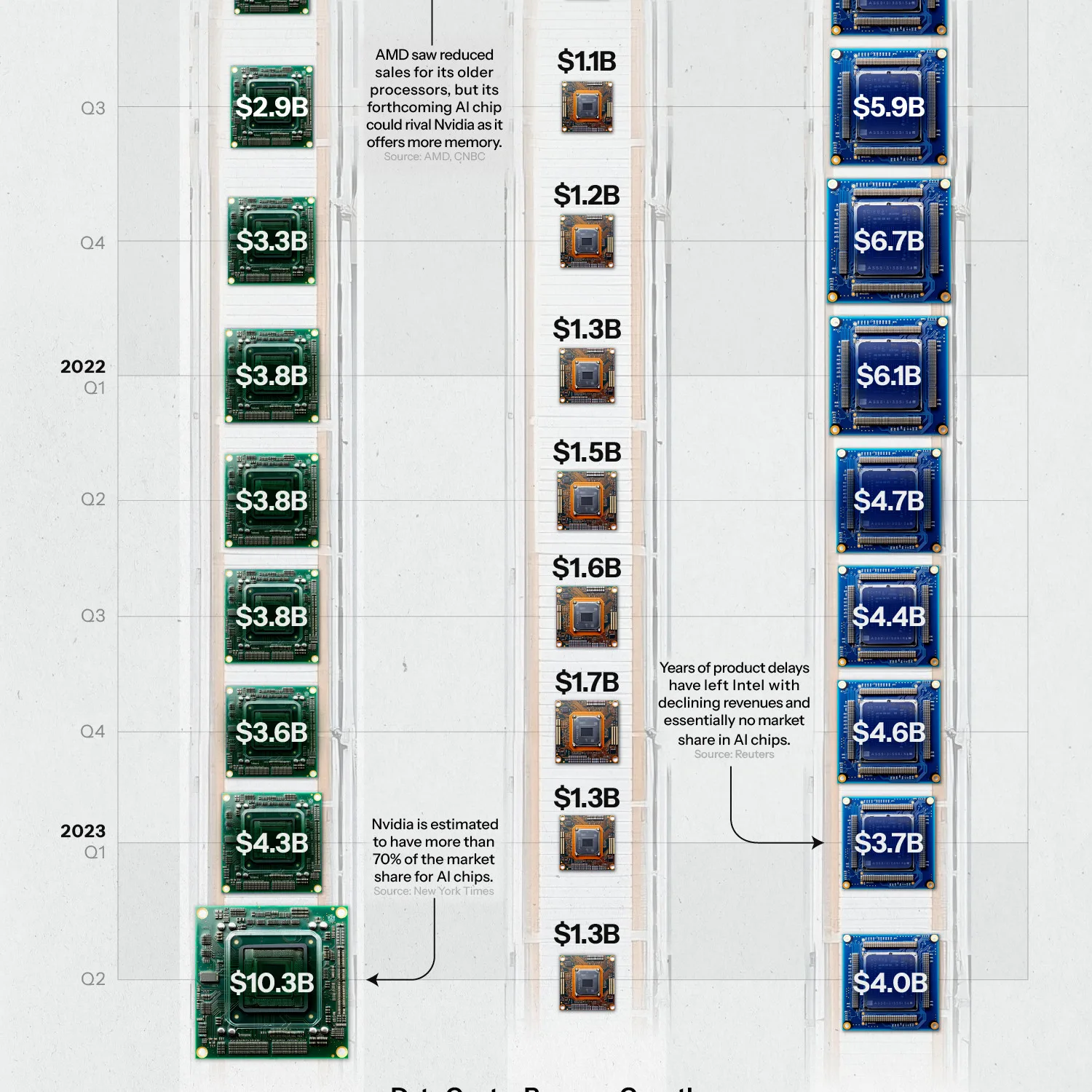

As investors look for promising opportunities in the semiconductor sector, AMD and Intel are two major players drawing attention amid turbulent market conditions. With considerable volatility plaguing tech stocks, particularly within the semiconductor industry, it’s critical to evaluate the prospects of both companies. AMD (Advanced Micro Devices), known for its innovative processors and GPUs, is set on a trajectory of growth fueled by its competitive strategy and increasing market share. Conversely, Intel, a long-standing giant in the semiconductor market, is in the midst of a transformative phase aimed at regaining its competitive edge. According to a strategist from Barchart, the sentiment towards AMD has recently improved due to solid quarterly earnings that have outpaced analysts’ expectations, suggesting a robust recovery. Meanwhile, Intel analysts remain cautiously optimistic but underline the ongoing challenges the company faces as it attempts to adapt to a dynamic technological landscape. The semiconductor downturn has prompted firms to reevaluate their strategies. Market challenges remain, and as the narrative unfolds, investors are urged to remain vigilant, analyzing quarterly results and company announcements to make informed investment decisions. This report serves as a comparative analysis of AMD and Intel’s stock performance, exploring key metrics, forecasts, and future prospects amidst the broader backdrop of market uncertainties.

AMD vs Intel: Which Stock is the Better Semiconductor Turnaround Candidate?