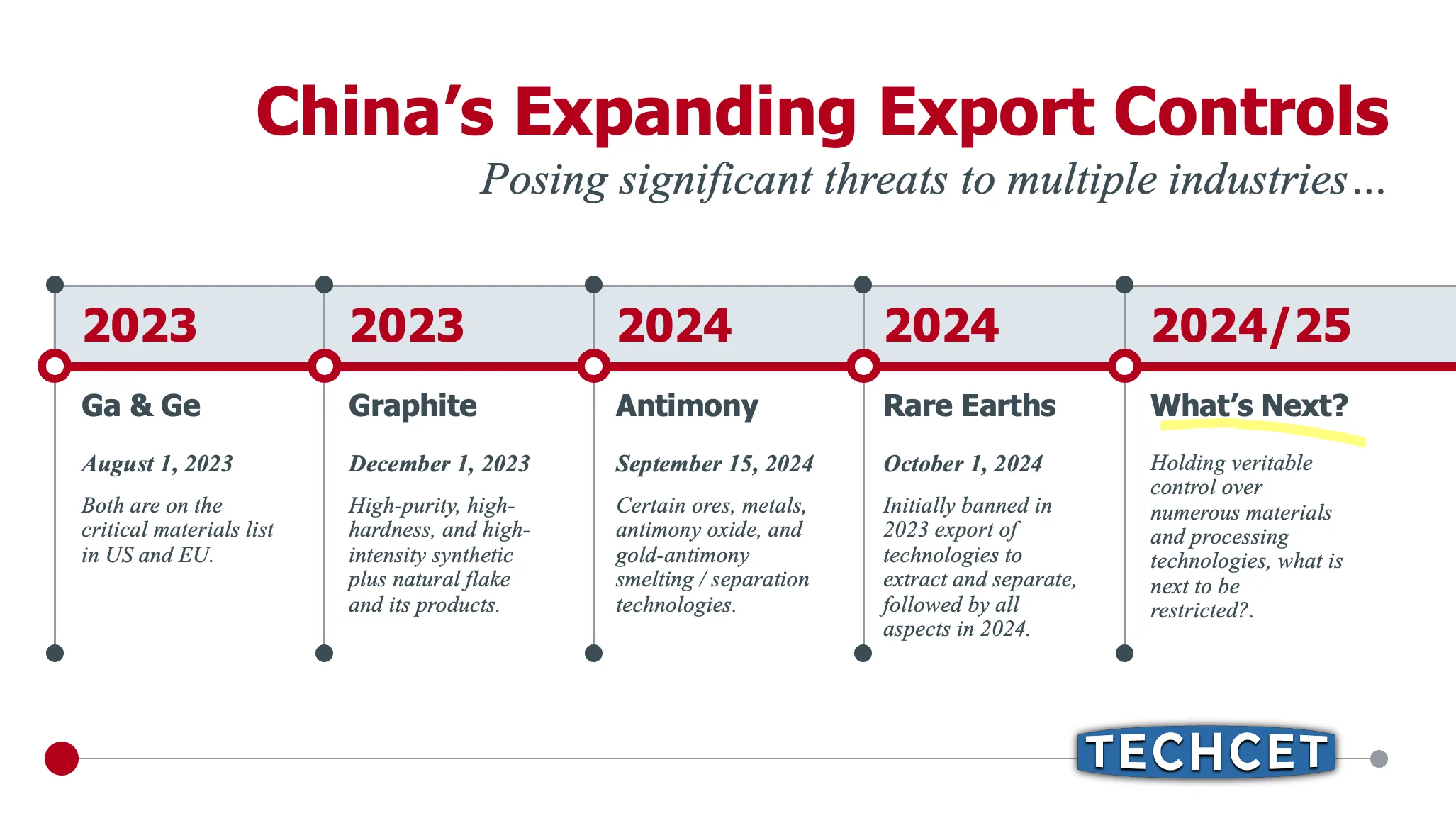

In a recent development that underscores the intensifying geopolitical tensions, China announced new restrictions on the export of critical minerals essential for semiconductor manufacturing, including gallium and germanium. The decision, which seeks to protect national security and facilitate China’s strategic advantage in technology, has significant implications for global supply chains, particularly for the United States and its allies. The response from the US has been swift, with officials highlighting the potential risks to the semiconductor industry’s growth.

US Secretary of Commerce Gina Raimondo stated, “China’s restriction on gallium and germanium exports will only serve to increase the urgency for us to strengthen our own supply chains and focus on domestic production.” The restrictions come amid ongoing disputes over trade practices, and experts predict that the move could lead to further slowdowns in the semiconductor market, impacting numerous sectors relying on advanced technologies. Experts have also pointed out that the United States imports a considerable amount of these minerals, primarily from China, which recently accounted for more than 60% of the global supply.

Simultaneously, Canadian mining advocates are leveraging this situation to combat existing tariffs imposed by former President Donald Trump. The Canada Mining Group has urged the Biden Administration to consider easing restrictions that could hinder the North American mining industry. The group argues that enhancing domestic mining operations could help alleviate the pressure brought on by China’s export limitations. According to a representative from the Canada Mining Group, “This is a perfect opportunity for us to strengthen our own mineral capabilities, ensuring we can support the semiconductor industry without dependence on risky regions.” The intersection of trade policies, mineral exports, and semiconductor production raises crucial questions about future market dynamics.