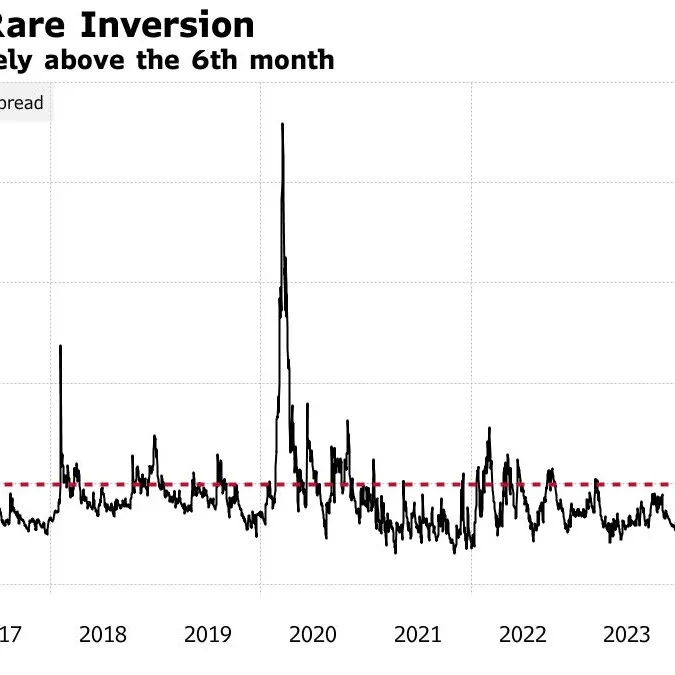

In a turbulent turn of events for U.S. financial markets, the VIX futures curve has sent distress signals, indicating potential further declines in equity prices. As the stock market shows signs of instability, options traders are preparing for a possible crash. According to Bloomberg, the volatility index (VIX) surged as investors sought protection against mounting risks, with the futures curve reflecting a pronounced backwardation. This shift denotes that traders expect higher volatility in the near term, reflecting deepening concerns about the stability of markets.

MarketWatch reports that options traders are bracing for a significant market downturn, as the anxiety surrounding global economic conditions continues to escalate. With the S&P 500 index recently experiencing a notable dip, it’s highlighted that comprehensive analysis by Cboe’s volatility expert suggests traders are increasingly hedging against potential tariffs and geopolitical tensions that raise the threat of a correction.

Cboe CEO Edward Tilly stated, ‘Volatility is the prevalent sentiment in the market right now. Traders have to be prepared for shifts that can lead to dramatic changes in the market landscape.’ The apprehensive environment is compounded by recent economic indicators that have not aligned with investor expectations, prompting preliminary forecasts of a sizable market correction. As such, cautious and strategic positioning in the options market is more critical than ever. As reported by CNBC, concerns are also mounting over inflation and interest rate trends, which could pose significant operational challenges for growth-focused companies. Investors are urged to remain vigilant as the market braces for volatility, aware that the current conditions could inspire uncertainty across various sectors.