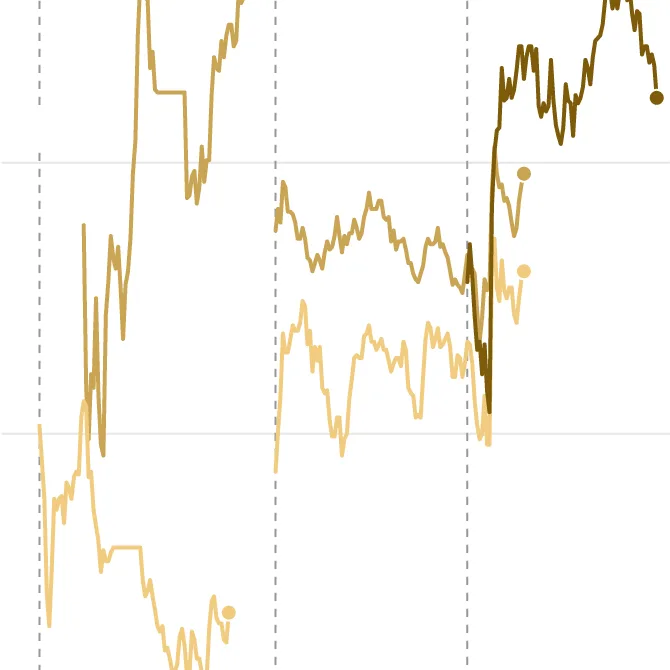

In a significant shift in international trade dynamics, the Trump administration has announced new tariffs that are set to impact global markets. Stock indices across the globe have shown declines, with technology stocks taking a notable hit, plunging down 7% since Trump’s inauguration. The S&P 500 index dipped by 1.8% on Monday following the tariff announcement, reflecting investors’ anxiety about potential trade wars. Prime Minister Justin Trudeau has spoken out against what he termed ‘unjustified’ US tariffs against Canada, asserting that they could severely disrupt bilateral trade relations. He emphasized, ‘Our government will stand up for Canadian workers and businesses against these unfair trade practices.’ The tariffs particularly target steel and aluminum imports, as well as several tech products, igniting fears of retaliation from affected countries, including Canada and the European Union. With China also warning of economic consequences, experts are advising companies to brace for volatile markets. The global economy, already under strain from the coronavirus pandemic, faces further challenges as the trade landscape grows more hostile. The market’s sensitivity to governmental policies highlights the intricate balance between economic growth and international relations.

Global Markets React to Trump Administration’s New Tariffs