In the rapidly evolving financial market, Exchange Traded Funds (ETFs) have gained significant traction among investors seeking diversified portfolios. A recent analysis highlights the ten best-performing ETFs over the past five years, showcasing their growth and return potential. Leading the pack is the Invesco QQQ Trust (QQQ), which has emerged as a favorite, featuring technology stocks from the Nasdaq-100 index and has achieved a staggering return of 228.39%. Following closely is the SPDR S&P 500 ETF Trust (SPY), recognized for its stability and broad market exposure, with a remarkable return of 100.34% over the same period. The iShares Russell 2000 ETF (IWM) showcases the performance of small-cap stocks and recorded a solid return of 91.97%. Additionally, the ARK Innovation ETF (ARKK), known for its focus on disruptive innovation, returns have been marked by volatility but reached an impressive 175.96%. The Financial Select Sector SPDR Fund (XLF), which focuses on financial sector companies, posted a return of 101.62%. The iShares Core S&P 500 ETF (IVV) provided a return of 100.11%, showing consistency alongside its SPY counterpart. Meanwhile, Invesco S&P 500 Equal Weight ETF (RSP) presented a unique strategy leading to a return of 106.42%. Following these leaders are the iShares MSCI Emerging Markets ETF (EEM) returning 13.33%, the Vanguard S&P 500 ETF (VOO) at 100.09%, and the iShares Global Clean Energy ETF (ICLN) boasting a return of 87.04%. These ETFs not only indicate the growth of the stock market but also reflect a broader trend toward funds that enable investors to navigate complex market dynamics. As always, when choosing an ETF, investors must consider their risk tolerance and investment goals.

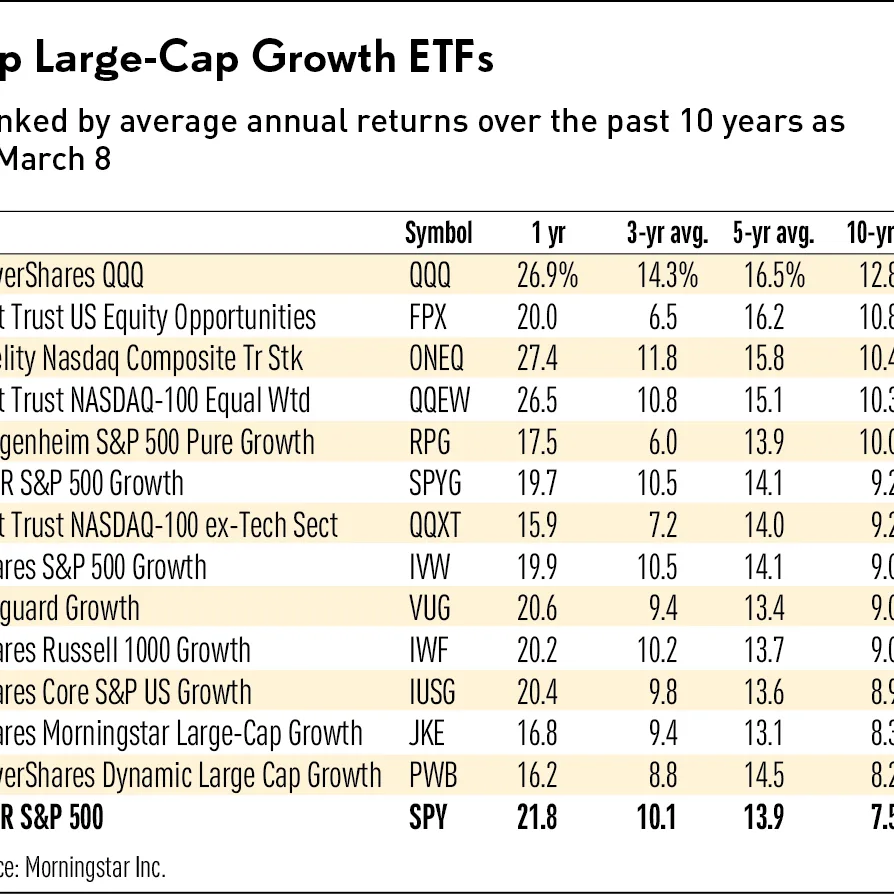

Top 10 Best Performing ETFs of the Last 5 Years