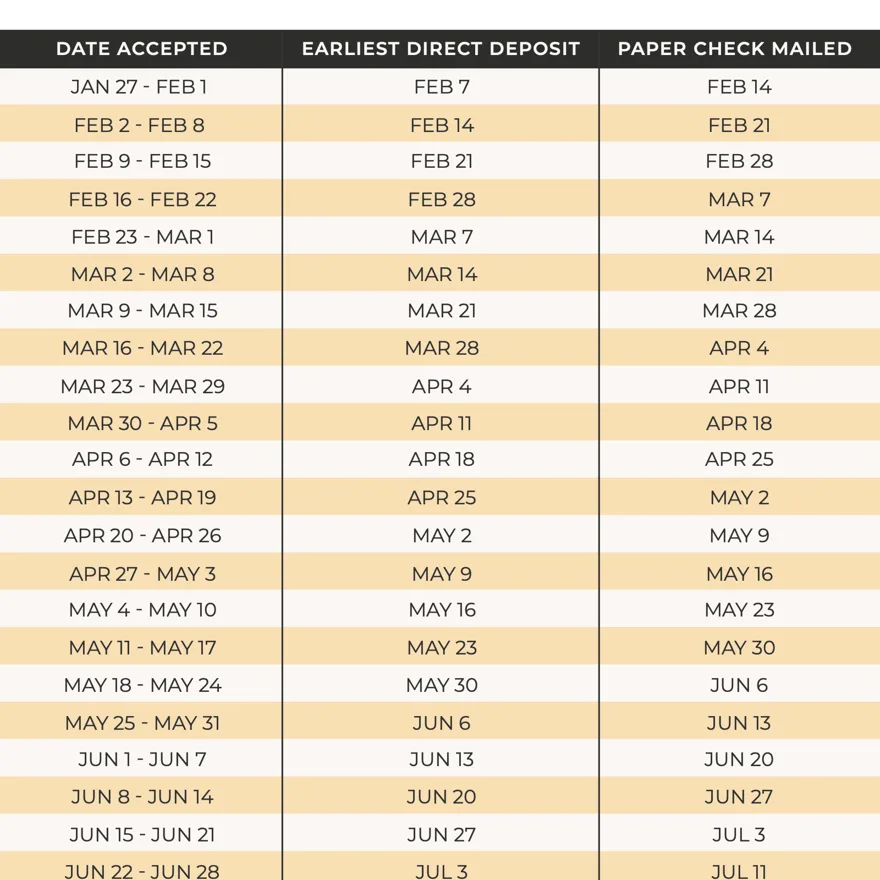

As the 2025 tax season approaches, questions surrounding tax refunds have surged. According to various reports, taxpayers can expect their refunds to typically be issued within 21 days of filing, if they choose to file their returns electronically with a direct deposit option. The IRS announced that most refunds will be issued on a rolling basis beginning in mid-February, following the IRS’s traditional timeline. “Refunds for most tax filers will follow a similar pattern as prior years but it is essential to file as early as possible to avoid delays,” said Kathy Pickering, Chief Tax Officer at H&R Block. With tax season officially opening on January 27, 2025, it is crucial for individuals to track their refunds through the IRS’s ‘Where’s My Refund?’ tool, which provides updates on the status of their refunds. Notably, the number of tax returns filed is expected to drop as well, with experts citing inflation and the rising costs of living as contributing factors. The IRS has implemented new safety measures to prevent fraud and ensure timely processing, ensuring that the taxpayers who need their refunds the most can receive them quickly. Timely filing is highlighted as key to meeting the April 15 deadline, and taxpayers should prepare their documents in advance. The IRS also notes that the timing of refunds can vary based on personal circumstances, including additional adjustments or credits, which may delay processing times. Experts emphasize the importance of understanding tax obligations and taking early action to minimize any stress associated with the tax refund process. This year, taxpayers are encouraged to visit the IRS website or consult tax professionals for personalized advice.

Key Insights on the 2025 Tax Refund Schedule: What You Need to Know