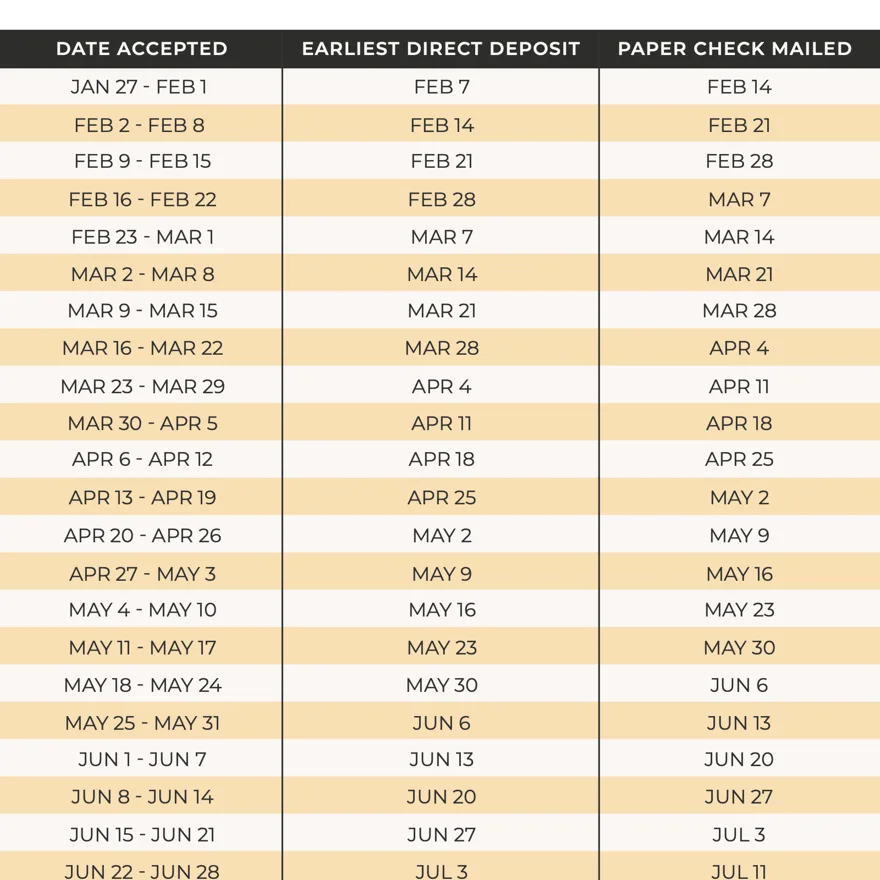

As taxpayers prepare for the 2025 tax season, the IRS has released essential information to help them file their 2024 tax returns efficiently. Key details include the necessary documentation, deadlines, and instructions for tracking refunds. According to the IRS, taxpayers are advised to gather their W-2 forms, 1099s, and other relevant documents by early January to ensure a smooth filing process. The agency has also stated that direct deposit remains the fastest option for receiving tax refunds, with the average refund amount expected to be around $3,000. Furthermore, in response to inquiries about the status of tax refunds, taxpayers can utilize the IRS ‘Where’s My Refund?’ tool for real-time updates on their refund progress. An IRS representative stated, ‘We encourage taxpayers to file electronically for faster processing and to ensure the accuracy of their returns.’ The 2025 tax season also coincides with layoffs at the IRS, which may affect processing times. Taxpayers are encouraged to check the IRS website for updates and guidance, especially in light of potential delays. Additionally, taxpayers in Pennsylvania can benefit from the state’s Direct File initiative, which allows for a streamlined process when filing state income tax returns. The 2024 tax return filings will officially start on January 20, 2025, with refunds expected to begin issuing approximately three weeks after submission, provided all forms are submitted correctly and on time. Taxpayers are urged to be proactive in learning about the filing requirements and timelines to avoid any last-minute complications.

IRS 2025 Tax Time Guide: Essential Information for Tax Filing and Refund Tracking