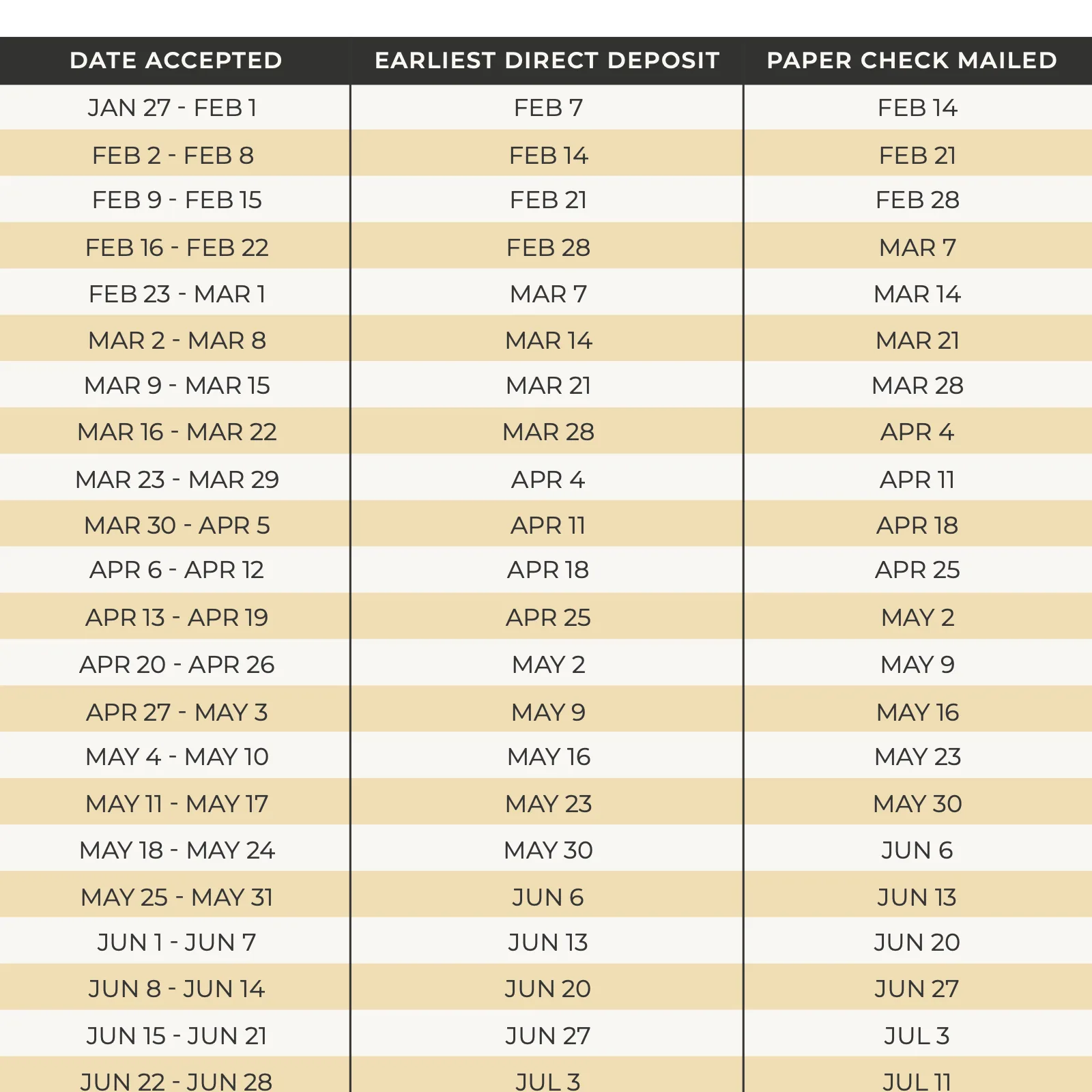

As taxpayers prepare for the upcoming tax season, understanding the IRS tax refund schedule for 2025 is crucial. The IRS is set to begin processing tax returns on January 23, 2025, providing a timeline for refunds that varies depending on how taxpayers choose to file. For those who file electronically and opt for direct deposit, the IRS expects to issue refunds within 21 days. However, for those who file by mail, refunds could take much longer, potentially extending up to several weeks. The IRS also highlighted that any disruptions in the processing could result from various factors, including staff shortages due to recent layoffs. Recent layoffs at the IRS, which impacted a significant number of employees, have caused concerns about potential delays in tax returns and refunds for the upcoming year. Despite these challenges, IRS representatives encourage taxpayers to remain informed and patient. For those looking to track their refund status, the IRS offers an online tool called ‘Where’s My Refund?’ available on their website. This tool allows taxpayers to check the status of their refund once it has been filed. Taxpayers can also communicate with the IRS via phone for additional inquiries, albeit with potential wait times. First-time filers or those who have changed their financial situations are urged to ensure their information is updated prior to filing. Furthermore, individuals are reminded to maintain accurate records to expedite the process. The IRS once again emphasizes the importance of early filing to avoid refund delays and ensure a smooth operation during tax season. Overall, the IRS remains committed to providing the best service possible and urges taxpayers to stay updated as the 2025 tax season approaches.

IRS Tax Refund Schedule for 2025: What You Need to Know