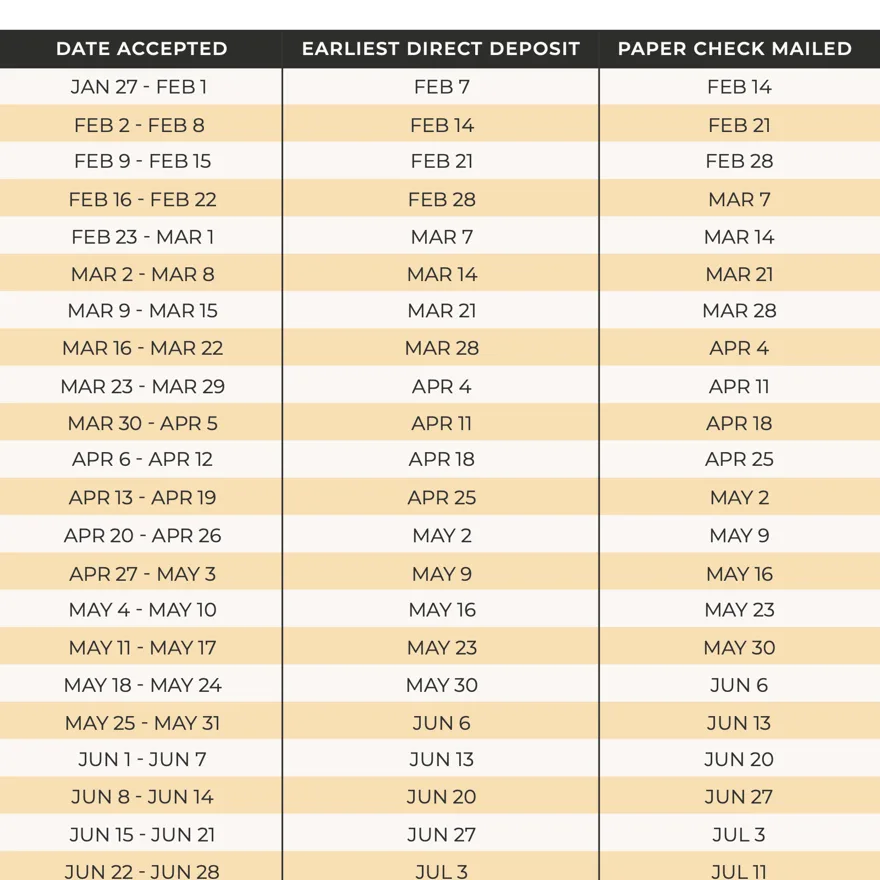

As taxpayers prepare for the 2025 tax season, the Internal Revenue Service (IRS) has released important information regarding the schedule for tax refunds this year. According to the IRS, taxpayers can start filing their 2024 tax returns on Monday, January 29, 2025. Taxpayers who choose e-filing, which is faster than traditional paper filing, can expect to receive their refunds typically within 21 days of successfully submitting an accurate return. The IRS also highlighted that those choosing to file paper returns may face delays that could extend to six months. The cutoff date for submitting all individual income tax returns for 2024 is April 15, 2025, unless that date falls on a weekend or holiday, in which case the deadline will be extended to the next business day. The IRS urges taxpayers to file their returns as early as possible to avoid last-minute rushes and to verify their information carefully to ensure the accuracy of their refunds. According to IRS spokesperson, Steven Mnuchin, “We understand the importance of timely tax refunds to taxpayers, and we are working diligently to process all returns as effectively as possible.” Although the IRS anticipates a smoother filing season than previous years, various factors, including potential legislative changes and processing capacity, may still impact refund timings. This year, taxpayers are reminded to keep an eye on their accounts and ensure that all necessary documentation is gathered ahead of filing. Additionally, common questions regarding tax credits, deductions, and eligibility can be found on IRS’s official website. Filers are encouraged to view their refund status using the IRS’s Where’s My Refund? tool available on their website, which can provide updates once the return has been officially filed.

IRS Announces Tax Refund Schedule for 2025: Key Dates for Filers and Refund Expectations